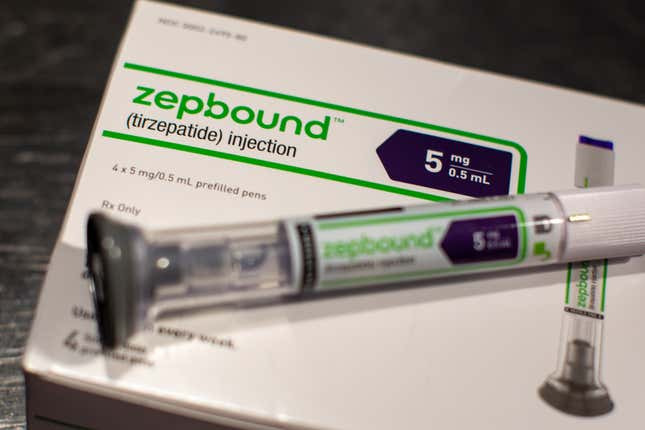

In recent years, the pharmaceutical industry has witnessed a seismic shift in the treatment of obesity, a chronic condition affecting millions worldwide. Among the frontrunners in this transformation is Eli Lilly’s Zepbound, a groundbreaking weight loss medication that has captured the attention of healthcare providers, patients, and investors alike. Approved by the U.S. Food and Drug Administration (FDA) in November 2023, Zepbound (tirzepatide) has quickly emerged as a game-changer in the obesity treatment landscape, offering unprecedented efficacy and versatility. This article delves deep into the science, impact, and future potential of Eli Lilly Zepbound, exploring its mechanism, clinical trial outcomes, market competition, and broader implications for health and wellness.

What is Eli Lilly Zepbound?

Zepbound is a once-weekly injectable medication developed by Eli Lilly and Company, a global pharmaceutical giant headquartered in Indianapolis, Indiana. Its active ingredient, tirzepatide, is a dual glucose-dependent insulinotropic polypeptide (GIP) and glucagon-like peptide-1 (GLP-1) receptor agonist. This dual-action mechanism sets Zepbound apart from other weight loss drugs, making it the first and only FDA-approved treatment of its kind for chronic weight management in adults with obesity or overweight conditions accompanied by at least one weight-related comorbidity, such as type 2 diabetes, hypertension, or dyslipidemia.

The approval of Zepbound followed the success of its sibling drug, Mounjaro, which shares the same active ingredient and was greenlit by the FDA in 2022 for type 2 diabetes management. However, Zepbound’s focus on obesity has tapped into a massive and growing market, with the Centers for Disease Control and Prevention (CDC) reporting that over 40% of U.S. adults were obese between 2021 and 2023. Keywords like “Eli Lilly Zepbound obesity treatment” and “Zepbound FDA approval” reflect the drug’s significance in addressing this public health crisis.

How Does Zepbound Work?

The science behind Zepbound is rooted in its ability to mimic two key gut hormones: GIP and GLP-1. These hormones are critical in regulating appetite, insulin secretion, and glucose metabolism. By activating both GIP and GLP-1 receptors, Zepbound offers a synergistic effect that enhances weight loss beyond what single-hormone agonists, like Novo Nordisk’s Wegovy (semaglutide), can achieve.

-

- Appetite Suppression: Zepbound slows gastric emptying and signals the brain to reduce hunger, helping patients feel fuller for longer.

-

- Improved Insulin Sensitivity: It boosts insulin production in response to meals, aiding in blood sugar control—a benefit that extends to patients with prediabetes or type 2 diabetes.

-

- Fat Metabolism: The drug promotes the breakdown of stored fat, contributing to significant body weight reduction.

This multifaceted approach has made Zepbound a standout in the realm of “GLP-1 weight loss medications,” a category that has exploded in popularity due to its efficacy and relatively tolerable side effect profile.

Zepbound Clinical Trial Results: A New Benchmark in Weight Loss

The efficacy of Eli Lilly Zepbound has been rigorously tested through the SURMOUNT clinical trial program, a series of Phase 3 studies that have set a new standard for obesity treatments. The most notable data comes from the SURMOUNT-5 trial, a head-to-head comparison with Novo Nordisk’s Wegovy, released on December 4, 2024. This trial enrolled 751 participants across the U.S. and Puerto Rico, all of whom were obese or overweight with at least one weight-related condition (excluding diabetes).

Key Findings from SURMOUNT-5

-

- Weight Loss: Patients on Zepbound lost an average of 20.2% of their body weight (approximately 50 pounds) after 72 weeks, compared to 13.7% (33 pounds) for those on Wegovy. This translates to a 47% greater relative weight reduction with Zepbound.

-

- Milestone Achievements: Nearly 32% of Zepbound users achieved at least 25% weight loss, compared to 16% of Wegovy users.

-

- Safety Profile: Both drugs exhibited gastrointestinal side effects (nausea, diarrhea, vomiting) that were generally mild to moderate, with Zepbound’s safety aligning with prior SURMOUNT trials.

These “Zepbound clinical trial results” underscore its superiority in the “Zepbound vs. Wegovy comparison,” providing Eli Lilly with a powerful marketing edge. The full data, set to be published in a peer-reviewed journal and presented at a 2025 medical meeting, will likely further solidify Zepbound’s position as a leader in the obesity drug market.

Zepbound vs. Wegovy: A Competitive Showdown

The rivalry between Eli Lilly’s Zepbound and Novo Nordisk’s Wegovy has become one of the most watched battles in pharmaceuticals. Both drugs belong to the GLP-1 receptor agonist class, but Zepbound’s dual GIP/GLP-1 mechanism gives it a distinct advantage. Wegovy, approved in 2021, relies solely on GLP-1 activation and has been a market pioneer, generating $6.8 billion in combined sales with its diabetes counterpart Ozempic in Q3 2024. Meanwhile, Zepbound and Mounjaro together brought in $4.4 billion for Lilly in the same period.

Why Zepbound Outperforms

-

- Greater Efficacy: The SURMOUNT-5 results confirm what earlier separate trials hinted at—Zepbound delivers more significant weight loss.

-

- Dual Mechanism: Targeting both GIP and GLP-1 pathways enhances its metabolic and appetite-regulating effects.

-

- Market Momentum: Despite Wegovy’s head start, Zepbound’s rapid uptake since its 2023 launch signals strong demand.

Analysts predict that “Zepbound weight loss efficacy” could help it overtake Wegovy, potentially reaching $27.2 billion in annual sales by 2030, according to GlobalData forecasts. However, supply constraints remain a hurdle for both drugs, as manufacturers race to meet soaring demand.

Expanding Access: Zepbound Single-Dose Vials

One of Eli Lilly’s boldest moves to address supply and affordability came in August 2024, when the company introduced Zepbound in single-dose vials. Unlike the prefilled autoinjector pens (priced at around $1,000 monthly before insurance), these vials are sold directly to consumers through LillyDirect, the company’s telehealth platform, at a significantly lower cost:

-

- 2.5 mg: $349 per month (down from $399 as of February 25, 2025)

-

- 5 mg: $499 per month (down from $549)

-

- 7.5 mg and 10 mg: Introduced February 25, 2025, at $499–$699 depending on refill timing.

This “Zepbound single-dose vials pricing” strategy targets self-pay patients, including those on Medicare or without insurance coverage for obesity drugs. By offering a “cheaper Zepbound alternative,” Lilly aims to combat the rise of compounded versions—less-regulated alternatives that have flooded the market amid shortages. Patients using vials draw the medication with a syringe, a shift from the convenience of pens but a practical solution to expand access.

Beyond Weight Loss: Zepbound’s Broader Health Benefits

While “Eli Lilly Zepbound weight loss” dominates headlines, the drug’s potential extends far beyond obesity. Clinical trials and real-world evidence suggest tirzepatide could address a range of conditions, positioning Zepbound as a versatile therapeutic tool.

Sleep Apnea Treatment

In April 2024, Eli Lilly announced that Zepbound reduced the severity of obstructive sleep apnea (OSA) in two late-stage trials. Patients with moderate-to-severe OSA and obesity saw a 63% reduction in apnea-hypopnea index (AHI) events after 52 weeks, far exceeding Wall Street’s 50% threshold for success. With an estimated 80 million Americans affected by OSA—20 million with moderate-to-severe cases—this “Zepbound sleep apnea treatment” indication could secure FDA approval in 2025, further expanding its market.

Heart Failure and Cardiovascular Health

Zepbound has also shown promise in heart failure with preserved ejection fraction (HFpEF). A Phase 3 trial reported in August 2024 found a 38% reduction in major complications (hospitalizations, urgent visits, or cardiovascular deaths) compared to placebo, alongside a 19.5-point improvement in quality-of-life scores. This aligns with Wegovy’s cardiovascular benefits but highlights Zepbound’s broader impact.

Diabetes Prevention

In prediabetes patients, Zepbound reduced the risk of progressing to type 2 diabetes by 94%, per a 2024 study. This “Zepbound diabetes prevention” potential could reshape preventive care, especially given the overlap between obesity and diabetes.

Market Impact and Investment Outlook

Eli Lilly’s stock (NYSE: LLY) has soared over 450% in the past five years, driven largely by the tirzepatide franchise. However, a February 2025 revenue shortfall—$45 billion versus a projected $45.4–$46 billion—tempered expectations, reflecting slower-than-anticipated growth in the U.S. incretin market. Despite this, Zepbound and Mounjaro continue to break records, each surpassing $1 billion in quarterly sales.

Competitive Landscape

Novo Nordisk remains a formidable rival, with its next-generation drug CagriSema (expected to achieve 25% weight loss) set to release late-stage data in 2025. Meanwhile, Lilly is advancing orforglipron, an oral GLP-1 drug in Phase 3, which could further disrupt the market. Keywords like “Zepbound market competition” and “future of GLP-1 drugs” capture this dynamic race.

Investment Considerations

Analysts at BMO and Morgan Stanley remain bullish, with price targets suggesting a 20%+ upside from current levels. Zepbound’s label expansions and manufacturing investments—such as a $5.3 billion commitment in May 2024—bolster its long-term growth potential, despite a high forward P/E ratio of 36.

Challenges and Controversies

Zepbound’s rise hasn’t been without hurdles. Supply shortages have frustrated patients and providers, while its high-cost limits access for uninsured populations. Gastrointestinal side effects, though manageable, lead some to discontinue treatment. Additionally, Lilly has taken a firm stance against cosmetic weight loss use, implementing verification processes to ensure vials reach patients with medical needs—a move that has sparked debate over “Zepbound accessibility issues.”

The Future of Eli Lilly Zepbound

As we move into 2025, Zepbound stands at the forefront of a burgeoning obesity treatment revolution. Its superior efficacy, expanding indications, and innovative delivery options position it as a cornerstone of Eli Lilly’s portfolio. Whether it becomes the best-selling drug of all time, as some predict, will depend on overcoming supply constraints, securing broader insurance coverage, and fending off competitors.

For patients, Zepbound offers hope—a scientifically backed solution to a condition long stigmatized as a lifestyle choice. For Lilly, it’s a testament to innovation, with ripple effects across healthcare and society. Keywords like “future of Eli Lilly Zepbound” and “Zepbound impact on obesity” reflect its transformative potential, ensuring its story is far from over.

![]()